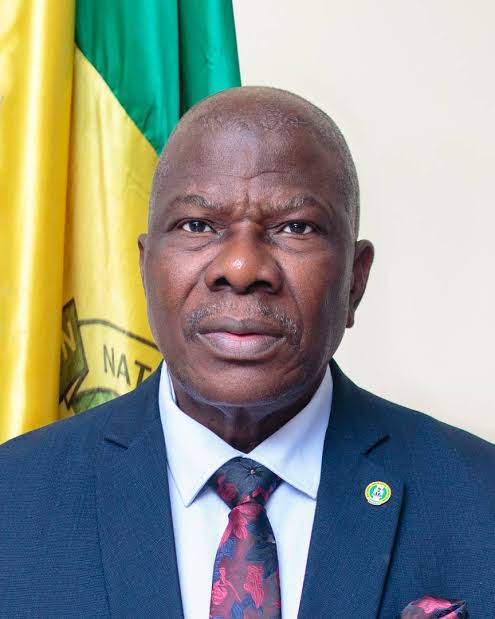

Mr. Sunday Thomas, the Commissioner for Insurance and Chief Executive Officer of NAICOM, has shed light on the substantial impact of the ongoing foreign exchange crisis and the prevalent inflationary trend on the insurance sector.

During an interactive session with journalists in Uyo, Akwa Ibom state on Thursday, Mr. Thomas unveiled the toll these economic challenges were taking on the insurance industry.

In the face of escalating exchange rates and inflation, Mr. Thomas highlighted the recurring issue of asset replacement. He underscored the need for astute individuals and entities to recalibrate their asset values to optimize benefits, since increased asset valuation translates to higher premiums.

“When confronted with diminished exchange rates, asset replacement invariably becomes a critical concern. Particularly when assets were procured at a specific cost, especially those reliant on foreign exchange, individuals tend to postpone the revaluation of their assets,” Mr. Thomas elucidated.

He went on to underscore the severe impact of inflation on life insurance. “Inflation invariably hits life insurance the hardest, as the value of insurance claims is profoundly undermined,” he noted.

Addressing the broader economic context, Mr. Thomas contextualized the current challenges as a consequence of recent shifts, including subsidy removal and the consolidation of exchange rates. These changes, he emphasized, are invariably met with resistance during the transition period.

“While the present challenges are indeed setbacks, it is crucial to recognize that pushbacks are an inherent aspect of such policy shifts and are likely to reverberate across all sectors of the economy,” Mr. Thomas elaborated.

Optimism permeated Mr. Thomas’s commentary as he observed that exchange rates were gradually self-adjusting downward. He alluded to ongoing efforts and initiatives geared toward mitigating these impacts, projecting that the comprehensive initiatives would eventually restore economic equilibrium.

Mr. Thomas expressed a hopeful outlook, asserting that while the situation might not fully revert to its previous state, it would eventually improve beyond the current adversity.